The highly anticipated 2024 Bitcoin halving is set to be a transformative event that will shape the future of the cryptocurrency market and potentially impact the broader financial landscape. As the third halving event in Bitcoin’s history, it marks a significant milestone that has historically influenced not only the price of Bitcoin but also global markets, stocks, and commodities. With the halving expected to occur in the first half of 2024, it is crucial for investors, businesses, and enthusiasts to understand its potential implications and prepare for the opportunities and challenges that lie ahead.

In this comprehensive article, lenous team will delve into the market outlook surrounding the 2024 Bitcoin halving, utilizing strategic analysis tools such as SWOT analysis, PESTEL framework, and foresight methods based on the Chartered Financial Analyst (CFA) approach. By examining the lessons learned from previous halvings and analyzing the current market dynamics, we aim to provide valuable insights to help you navigate the complex and ever-changing landscape of cryptocurrencies and global finance.

The Global Financial Market and the Bitcoin Halving

The global financial market, a vast and interconnected system encompassing various asset classes, is not immune to the effects of the Bitcoin halving. As cryptocurrencies continue to gain recognition and adoption, the halving event has the potential to create ripple effects throughout the financial landscape, influencing investor sentiment, market volatility, and the flow of capital across borders.

To understand the potential impact of the 2024 Bitcoin halving on the global financial market, it is essential to conduct a thorough SWOT analysis. The strengths of the cryptocurrency market include the increasing institutional adoption of digital assets, the growing recognition of Bitcoin as a store of value, and the decentralized nature of cryptocurrencies, which offers a level of autonomy and resilience against traditional financial systems. However, the market also faces weaknesses, such as regulatory uncertainty, high volatility, and a limited understanding of cryptocurrencies among the general public.

The 2024 Bitcoin halving presents significant opportunities for the global financial market. As the supply of new Bitcoins is reduced, the scarcity of the asset may drive increased demand and potentially lead to price appreciation. This, in turn, could attract more institutional investors and spur collaboration between traditional finance and the crypto industry, leading to the development of new financial products and services that bridge the gap between the two worlds.

However, the global financial market also faces threats in the context of the Bitcoin halving. Macroeconomic factors, such as economic downturns, geopolitical tensions, and shifts in monetary policies, can impact market sentiment and create uncertainty. The emergence of competing technologies and the potential for cybersecurity breaches also pose risks to the stability and integrity of the cryptocurrency market.

PESTEL Analysis

To gain a comprehensive understanding of the external factors that may influence the market outlook surrounding the 2024 Bitcoin halving, it is crucial to conduct a PESTEL analysis. This framework examines the political, economic, social, technological, environmental, and legal aspects that shape the cryptocurrency landscape.

From a political perspective, governments worldwide are grappling with the challenges of regulating cryptocurrencies. The varying approaches taken by different jurisdictions, ranging from supportive to restrictive, can create a fragmented regulatory landscape and impact market sentiment. Economic factors, such as interest rates, inflation, and monetary policies, also play a significant role in shaping the demand for alternative assets like Bitcoin.

The social aspect of the PESTEL analysis highlights the growing public awareness and acceptance of cryptocurrencies, particularly among younger generations. The potential for financial inclusion through decentralized finance (DeFi) and the increasing adoption of digital payments are driving social shifts that may fuel the growth of the cryptocurrency market.

Technological advancements are at the core of the Bitcoin halving and the broader cryptocurrency ecosystem. Ongoing developments in blockchain scalability, interoperability, and integration with traditional financial infrastructure are crucial for the long-term success and mainstream adoption of cryptocurrencies. The rise of central bank digital currencies (CBDCs) and the exploration of energy-efficient consensus mechanisms also shape the technological landscape.

Environmental concerns surrounding the energy consumption of Bitcoin mining have gained attention in recent years. The shift towards renewable energy sources and the development of more sustainable mining practices will be key factors in addressing these concerns and ensuring the long-term viability of the cryptocurrency industry.

From a legal standpoint, the evolving regulatory landscape poses both challenges and opportunities for the cryptocurrency market. Compliance requirements for crypto exchanges, anti-money laundering (AML) and know-your-customer (KYC) regulations, and the need for clear legal frameworks and investor protection measures are critical considerations that will shape the future of the industry.

The Impact on Stocks and Commodities

While the direct impact of the Bitcoin halving on the stock market may be less pronounced compared to the cryptocurrency market itself, the increasing integration of cryptocurrencies with traditional finance has the potential to create correlations and spillover effects. As more companies and investors recognize the potential of blockchain technology and digital assets, the emergence of crypto-related sectors, such as mining companies, blockchain service providers, and cryptocurrency exchanges, presents new investment opportunities in the stock market.

However, the stock market may also face challenges in the context of the Bitcoin halving. Regulatory hurdles, uncertainty surrounding the legal status of cryptocurrencies, and the potential for volatility spillover from the crypto market can impact investor sentiment and create risks for publicly traded companies with exposure to digital assets.

In the realm of commodities, Bitcoin’s potential to serve as a digital gold and inflation hedge has sparked discussions about its relationship with traditional safe-haven assets. The halving event is expected to have a direct impact on the supply and demand dynamics of Bitcoin, potentially attracting more investors seeking alternative assets to diversify their portfolios. As the scarcity of Bitcoin increases, it may strengthen its perceived value and create competition with physical commodities like gold.

Lessons from Previous Halvings

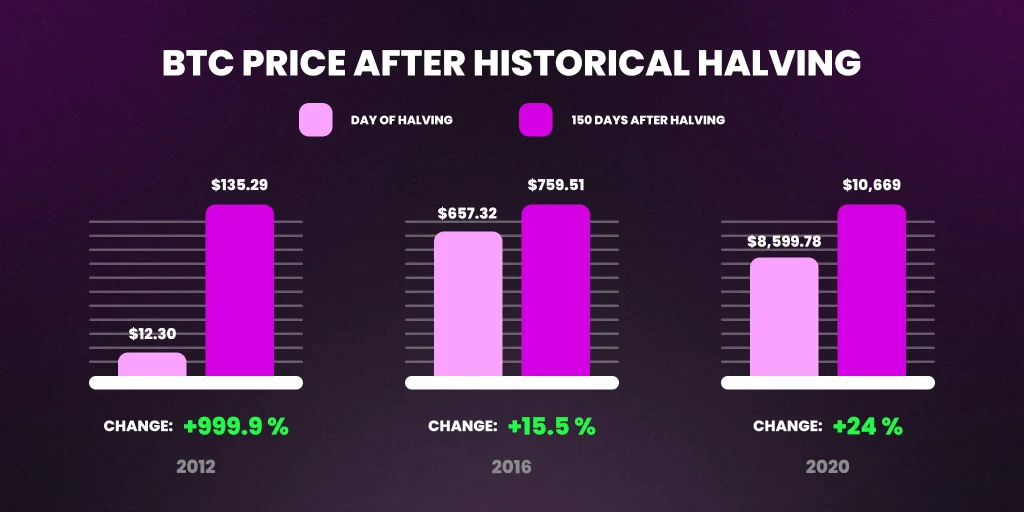

To gain a comprehensive understanding of the potential impact of the 2024 Bitcoin halving, it is essential to examine the lessons learned from previous halving events. Bitcoin has undergone two previous halvings, in 2012 and 2016, each with its own unique market dynamics and outcomes.

The 2012 halving, which reduced the block reward from 50 BTC to 25 BTC, occurred during the early stages of Bitcoin’s development. In the months leading up to the event, Bitcoin’s price experienced significant volatility, with a peak of around $31 in June 2011 followed by a decline to approximately $2 by November 2011. However, after the halving, Bitcoin’s price gradually increased, reaching a high of around $1,150 by December 2013. This halving event demonstrated the potential for price appreciation post-halving, although the market was still relatively nascent and subject to high volatility.

The 2016 halving, which further reduced the block reward from 25 BTC to 12.5 BTC, took place in a more mature market environment. In the months preceding the halving, Bitcoin’s price experienced a significant rally, rising from around $400 in early 2016 to nearly $800 by June 2016. Following the halving, Bitcoin’s price continued its upward trajectory, reaching an all-time high of approximately $20,000 by December 2017. The 2016 halving showcased the anticipatory nature of the market, with investors pricing in the expected supply reduction before the actual event.

The 2020 halving, the most recent event, occurred in a unique market context amid the COVID-19 pandemic. Prior to the halving, Bitcoin’s price experienced a sharp decline in March 2020, falling from around $10,000 to below $5,000 due to the global economic uncertainty. However, the price recovered in the following months, reaching a new all-time high of nearly $65,000 by April 2021. The 2020 halving highlighted the resilience of the Bitcoin market and the increasing institutional interest in cryptocurrencies, despite the challenging macroeconomic conditions.

These previous halving events offer valuable lessons for market participants as they prepare for the 2024 Bitcoin halving. One key takeaway is that Bitcoin’s price tends to experience significant volatility leading up to and following the halving event. The anticipation of reduced supply often drives price appreciation in the months preceding the halving, as investors seek to position themselves ahead of the event.

However, it is important to note that each halving occurs in a unique market context, and historical patterns may not necessarily repeat themselves. The long-term impact of the halving on Bitcoin’s price is influenced by various factors, including market sentiment, regulatory developments, and broader economic conditions.

Conclusion: 2024 Bitcoin halving

The 2024 Bitcoin halving represents a pivotal moment for the cryptocurrency market and the broader financial landscape. As the event approaches, it is crucial for investors, businesses, and policymakers to stay informed about the evolving market dynamics and prepare for the opportunities and challenges that lie ahead.

By employing strategic analysis tools like SWOT, PESTEL, and foresight methods, we can navigate the complexities of the market and identify the key drivers, risks, and potential outcomes. The lessons learned from previous halving events provide valuable insights into the market’s behavior and the anticipatory nature of investor sentiment.

As the cryptocurrency market continues to mature and integrate with traditional finance, the impact of the 2024 Bitcoin halving will extend beyond the realm of Bitcoin itself. The global financial market may experience increased correlation and spillover effects, while the stock market and commodities space may see the emergence of new investment opportunities and challenges.

To thrive in the post-halving era, market participants must stay adaptable, embrace innovation, and maintain a long-term perspective. By fostering collaboration, promoting regulatory clarity, and leveraging technological advancements, the cryptocurrency industry can pave the way for sustainable growth and mainstream adoption.

As we approach the 2024 Bitcoin halving, it is an exciting time to be part of the rapidly evolving world of cryptocurrencies and decentralized finance. By staying informed, proactive, and open to new possibilities, investors and businesses can position themselves to capitalize on the opportunities that this transformative event presents.

Stay tuned to Lenous Protocol for more expert insights, analysis, and updates on the 2024 Bitcoin halving and its impact on the market landscape. Together, we can navigate the future of finance and shape the destiny of the cryptocurrency revolution.